Report on the Digital Asset Tax Roundtable: Compliance Challenges,Opportunities & Way Forward

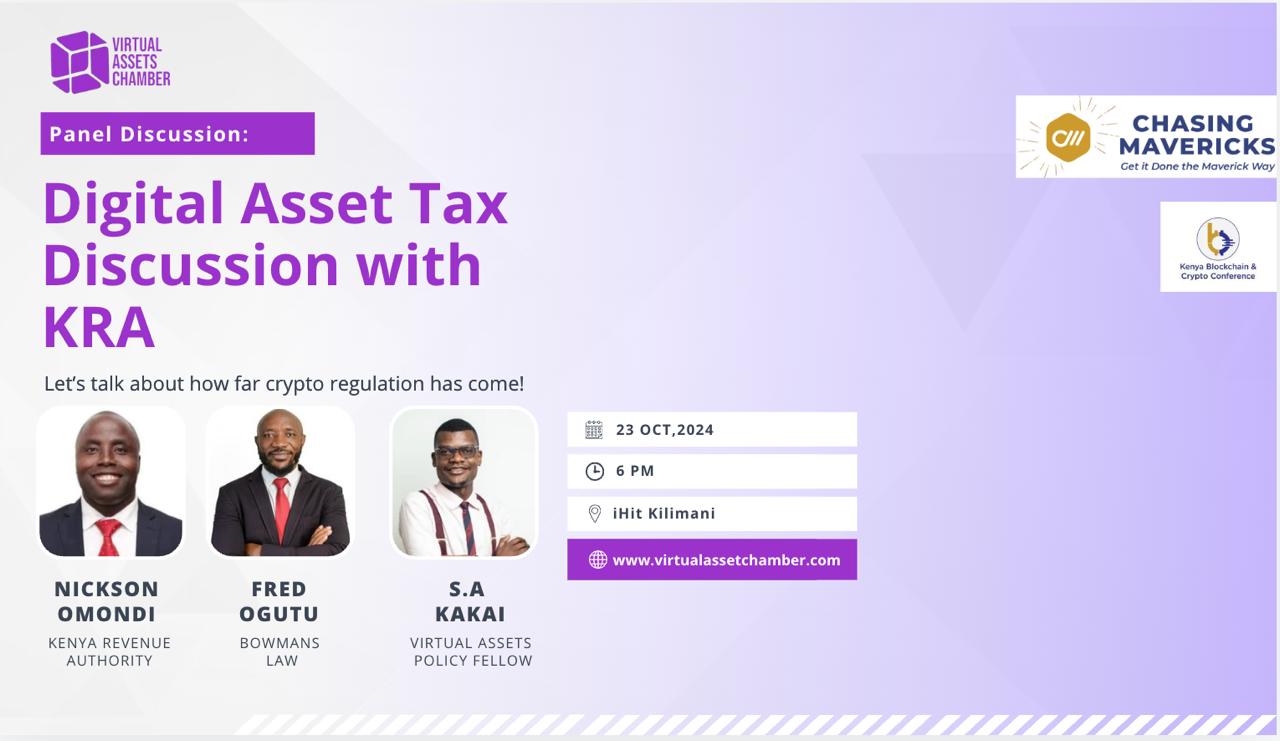

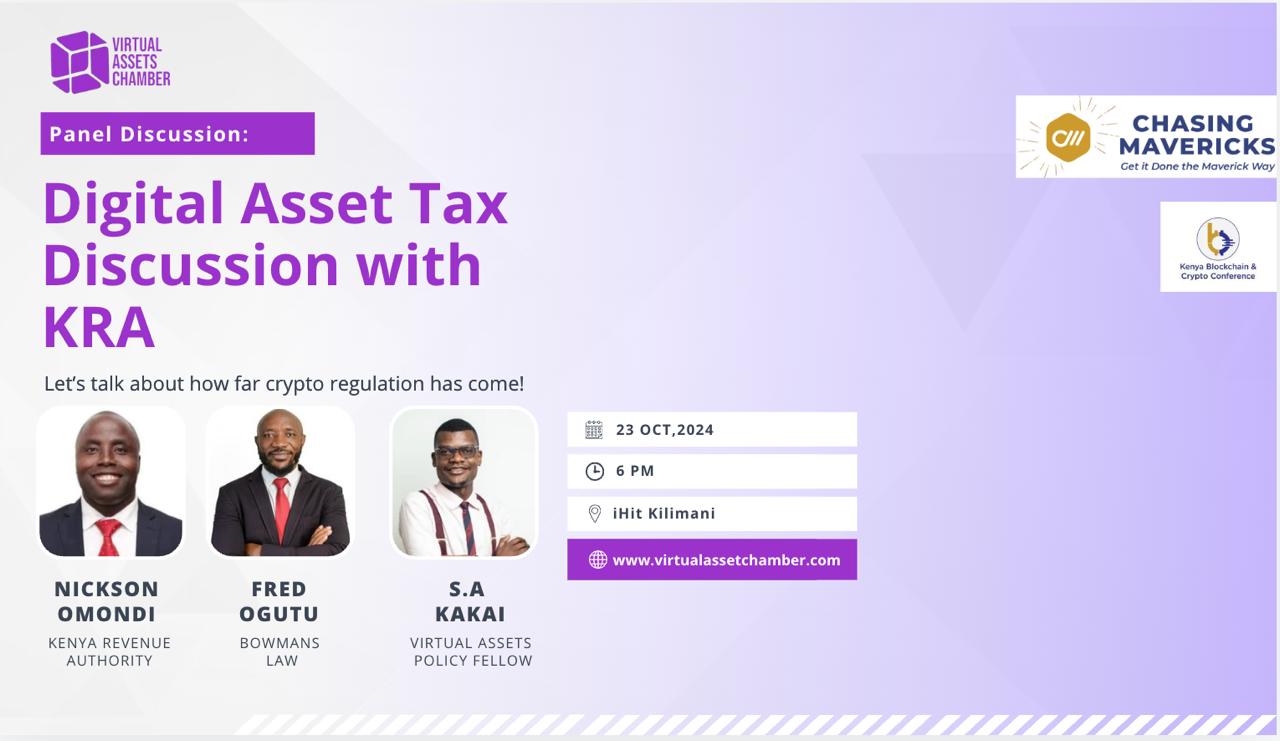

The Digital Asset Tax Roundtable, held on October 23, 2024, in Nairobi, served as a critical forum for discussing the implications of Kenya's emerging tax regulations on digital assets. Organised by the Virtual Asset Chamber of Commerce in collaboration with the Kenya Blockchain & Crypto Conference, the roundtable gathered various stakeholders, including representatives from the Kenya Revenue Authority (KRA), to address the legal and compliance challenges posed by the evolving digital economy. The discussion emphasised the complexities surrounding the Digital Asset Tax introduced under the Finance Act 2023, effective September 1, 2023, and examined potential pathways for streamlining compliance and safeguarding business sustainability.

Effective from September 1, 2023, this section introduced the 3% tax on digital assets, including cryptocurrencies. This tax is incurred by crypto asset traders in their swap or trading activities. In practice, a trader sending a crypto asset will end up incurring a 3% tax deduction for such a transaction. The exchange has the obligation of withholding the said tax.

Initially introduced on July 1, 2021, as a 1.5% tax on income earned by non-resident digital service providers, the DST was later expanded to encompass resident entities involved in digital services.

Exchanges are further required to pay 16% VAT on their same commissions.

Resident exchanges are also required to pay CIT on their income.

Although the 8th Schedule of the Income Tax Act covers capital gains tax, digital assets such as cryptocurrencies and securities listed on the Nairobi Securities Exchange (NSE) remain exempt.

The private sector concern was that, although the Digital Asset Tax functions similarly to a transaction tax, its basis under income tax laws raises a constitutional argument about taxing gross transaction values instead of net income, potentially impacting loss-making transactions.Basically a blanket tax that taxes traders whether or not a profit is being made seems unfair and regressive to the sector. This is a subject of an ongoing tax petition which is part of the bunch of petitions against the Finance Bill 2023.

In countering this argument, Mr. Omondi gave a case example of a blanket tax that uses the same model - Turnover Tax (Section 12C) which applies at a 1.5% flat rate on businesses with gross annual income below KES 25 million.

Furthermore, the Central Bank of Kenya Act cautionary notice restricting banks from supporting crypto asset companies raises concerns of practicality. To date, crypto asset companies cannot legally hold bank accounts in any Kenyan bank. There have been several cases of those attempting to open such accounts having their accounts shut down and funds seized in certain cases.

A recurring theme was the difficulty of reconciling daily transactions within the statutory five-day tax payment window. While KRA is working towards technological solutions that would facilitate real-time tax compliance, there remains a need for regulatory flexibility, particularly concerning the categorization of digital asset transactions.

For instance:

There were concerns that high tax rates and compliance costs could push cryptocurrency businesses out of the country, reducing Kenya's competitiveness as a regional fintech hub. The need for policy adjustments to avoid stifling innovation was emphasised, including potential tax exemptions or concessions for businesses operating within regulatory sandboxes.

Participants also highlighted the recent KRA proposal for an automated tax collection system that would integrate with cryptocurrency exchanges. While this could simplify compliance, S.A. Kakai, Policy and Regulatory Engagement Lead at the Virtual Asset Chamber of Commerce, stressed the need for a comprehensive legal framework that balances tax obligations with the operational realities of businesses. Would this move be potentially considered hostile thus driving investment and innovation away from the country? The implementation details for the automated system and the legal parameters surrounding its use remain under development.

Key legal provisions discussed included:

Allows taxpayers to seek private rulings from the Commissioner for unique transactions. Clarifying the scope of this section could accommodate the unique nature of digital asset transactions.

Addresses public rulings, which can guide general industry compliance. KRA is urged to issue guidance on aspects such as the tax treatment of cryptocurrency transactions to alleviate legal uncertainties.

Governs withholding tax obligations, typically applied to income sourced from betting or contractual payments. Participants questioned whether this provision could be applied to exchanges acting as intermediaries in crypto transactions, potentially creating a double-taxation scenario.

Mr. Omondi mentioned the potential adoption of the OECD Crypto Reporting Framework as a means to standardise reporting obligations and information sharing across jurisdictions. This approach could ease compliance burdens by harmonising tax treatment and data-sharing mechanisms.

Hillary James, a regulatory sandbox expert raised the issue of fragmented regulation, with uncertainty over which regulatory body oversees virtual assets; whether the Capital Markets Authority (CMA) or another agency. Kenya's regulatory sandbox initiatives have seen blockchain-based projects, particularly in Real-World Asset (RWA) tokenization, but broader regulatory guidelines for virtual assets remain unclear.

The Virtual Assets chamber shall initiate a formal inquiry to the commissioner under section 65 and 66 of the ITA raising key concerns for the commissioner to issue interpretative guidance or rulings on the taxation of specific digital asset transactions, including swap events and the use of digital assets as payment. Separately, the Virtual Assets chamber shall also engage with the Joint Financial Sectors Regulatory Forum on various other issues above and beyond tax such as licensing and sandboxing Technical Committee can expedite the issuance of tax clarifications.